The Future of Investing in the Digital World

In the era of digitization, where the boundaries between virtual and physical reality are blurring, the term “Real World Assets” (RWA) is taking on new significance. But have you ever considered that alongside real estate, crops, or collections, there might exist something like “Real World Art”? Both of these concepts undoubtedly open new horizons for investors, but they do so in different ways. Why are they important, and what distinguishes them?

What Are Real World Assets (RWA)?

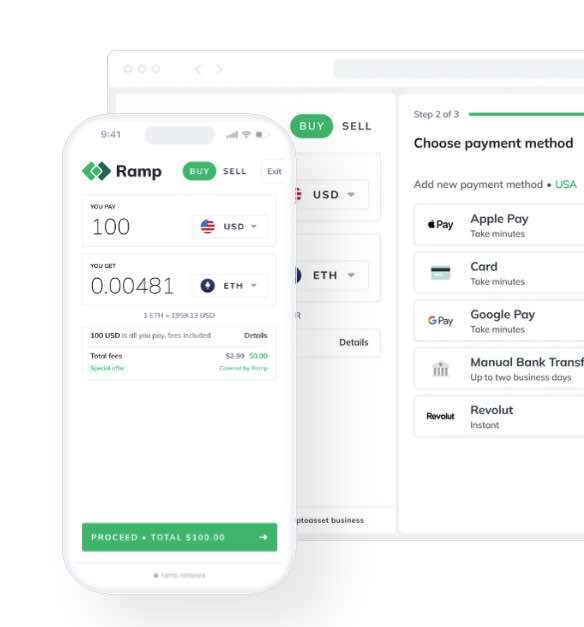

Real World Assets are tangible assets that can be tokenized, meaning they can be converted into digital tokens representing a share of ownership in a given asset. Thanks to blockchain technology and smart contracts, RWAs become more accessible for investors. You can invest in real estate, a company, agricultural crops, or even rare collections. Smart contracts manage the investment and automatically transfer profits to investors’ digital wallets.

Real World Art – The New Wave in Art

Just like RWA, Real World Art involves tokenizing pieces of art. Platforms like unidecentral-art.com allow you to “slice” a piece of art into fragments, which are then sold as NFTs (Non-Fungible Tokens). An investor can become an owner of, for example, 1 out of 10,000 pieces of a painting. Additionally, investors have a chance to win rewards for participating in primary market purchases.

Exploring a New Horizon for Artists and Collectors: An Example

Here’s an example of an image divided into smaller fragments in the form of NFTs. Although the artist chose to upload a lower-quality image in this case, the possibilities are much greater. Thanks to advanced technologies, images can be uploaded with sizes up to 70 MB and resolutions reaching 120,000 pixels. This means that an image divided into 10,000 NFTs can maintain very high quality.

Such an approach has many advantages for both artists and collectors. For artists, it offers a chance for wider distribution of their works. At the same time, it maintains a high level of detail and quality. For collectors, it presents an opportunity to invest in pieces of art. This is done in a more accessible way. There is no need to purchase the entire image. Moreover, the high quality of these ‘miniature’ fragments makes each NFT an attractive and valuable element of a collection.

It’s also worth noting that the higher the quality of the image, the more it can influence its value on the secondary market. The better the quality, the greater the interest from collectors, which in turn can lead to an increase in price. Ultimately, this technology opens up new horizons for the world of art. It also impacts investing in art. This allows both creators and investors to take full advantage of the digital era.

Similarities and Differences

Accessibility

Both of these models democratize investing. They make assets available to a broader range of people. Previously, these people couldn’t access them due to high financial barriers.

Value

Both RWA and Real World Art have the potential to generate profits, but the valuation mechanisms may differ. For RWAs, the value is often tied to the market in which the asset operates. In the case of art, the value is more subjective and can be subject to short-term fluctuations.

Liquidity

In both cases, the investor can sell their token at any time. However, Real World Art, being art markets, might be less liquid than other types of RWAs, making it more challenging to sell.

Management and Risk

Smart contracts in the case of RWA automate many aspects of management, potentially minimizing risk. With Real World Art, risk is more frequently tied to the subjective value of the art piece and may be less predictable.

Conclusion / Real World Assets

Real World Assets and Real World Art are two fascinating approaches to investing in tangible assets in digital form. Both methods offer unique benefits and risks. However, they also open doors to a future of investing. In this future, the boundaries between “reality” and “virtuality” are becoming increasingly fluid. Are you ready for a future where you can co-own not just real estate or crops, but also pieces of art? If so, both RWA and Real World Art offer intriguing possibilities.