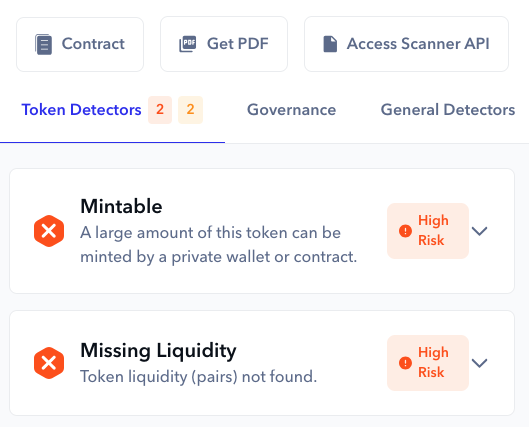

Mintable

A large amount of this token can be minted by a private wallet or contract.

The claim regarding the potential to mint a large quantity of ART tokens by a private wallet or contract is due to a misinterpretation of the contract’s purpose and functionality.

We explain what’s going on – and we expect a correction from De.Fi Scanner

Contract Operation Details

First Phase

- Issuance of 475,000,000 ART tokens, divided into two sales stages.

Second Phase

- Issuance of 1,497,000,000 ART tokens, divided across six sales stages.

Each stage is designed with the issuance of ART tokens at an incrementally higher price, to protect against speculative practices and ensure the project’s stability.

For detailed information about the presale phase and its stages, please refer to the official site: Official Presale Page.

Code Explanation

Internal Call

- The

_mint(user, amount)indicates that the mint function is used internally within the contract to allocate tokens to a user in a specified amount.

Balance Update Expression

- The expression

_balances[account] += amountis a typical ERC contract operation that updates the user’s balance by adding the specified amount of minted tokens.

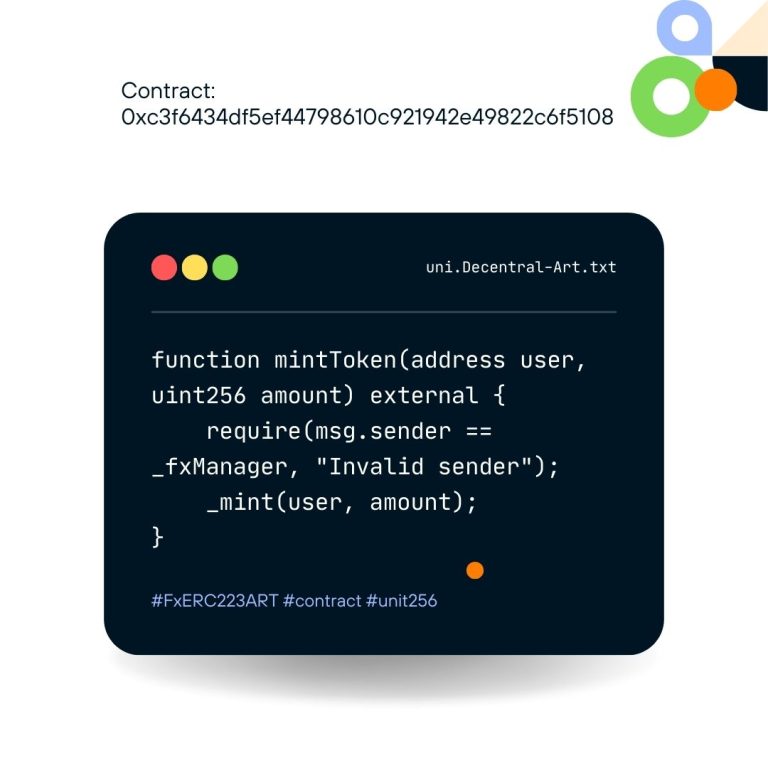

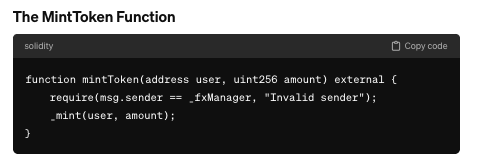

The MintToken Function

function mintToken(address user, uint256 amount) external {

require(msg.sender == _fxManager, “Invalid sender”);

_mint(user, amount);

}

This function is safeguarded by a require check that only allows the mintToken function to be called by the authorized contract manager address (_fxManager), thus preventing unauthorized token minting.

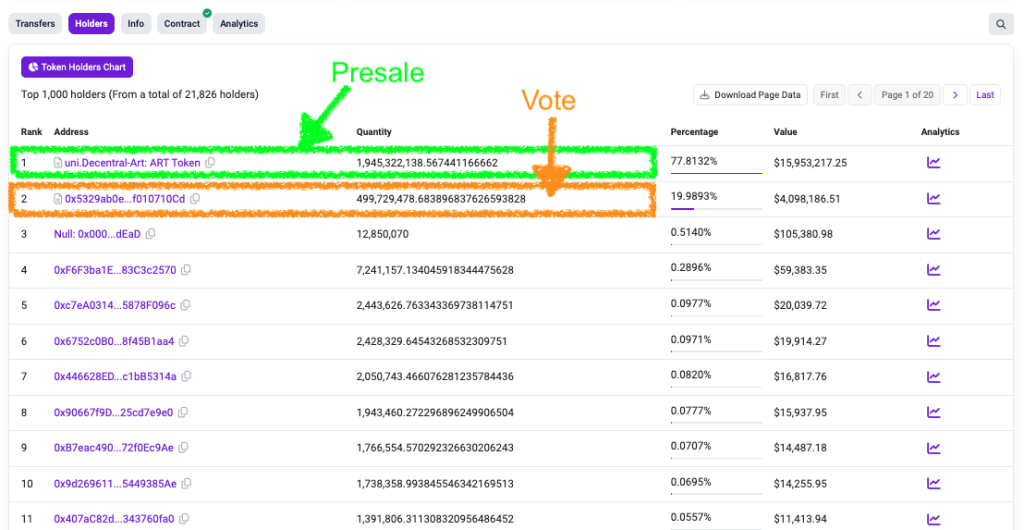

PRESALE – Smart contrakt

We would like to clarify the status of ART tokens during the Presale phase, which can be found at https://uni.decentral-art.com/pre-sale. The tokens allocated for the Presale are securely locked within a dedicated smart contract and are not transferable outside of the Presale mechanism. This design ensures that there can be no unauthorized use or premature release of tokens onto the market. The smart contract is programmed to only permit the acquisition of tokens through the official Presale process, thereby eliminating the possibility of an unexpected ‘token dump’ on the market. This measure is in place to maintain the integrity of the Presale and to protect early investors and participants.

VOTE Smart contract

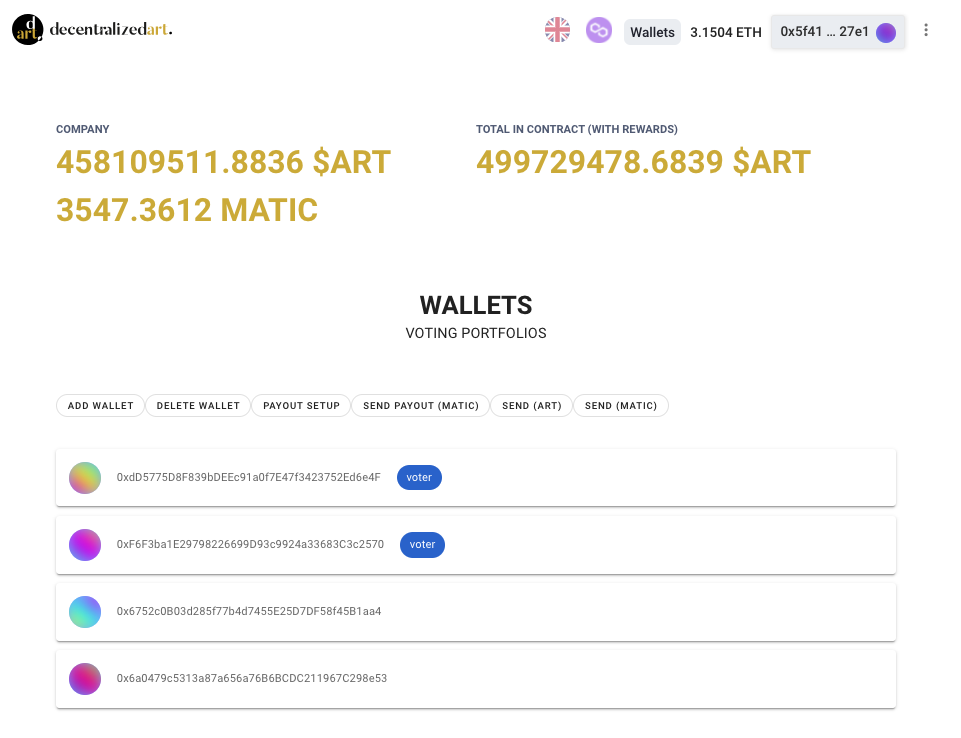

Located at 0x5329ab0ee04029d5a0ad4ac09c8fa7ff010710cd on PolygonScan functions as a decentralized treasury for a company, overseeing the management of corporate funds with an emphasis on transparency and community governance.

Within this contract are stored ART and MATIC tokens, which serve a dual purpose:

- Liquidity Provision: A portion of these tokens is reserved to ensure the smooth operation of trade on the platform, providing the necessary liquidity to facilitate transactions without delays or disruptions.

- Corporate and Reward Funds: Additionally, the contract holds the company’s operational funds, as well as ART tokens designated for distribution as rewards to users. paid automatically through a drawing tool.

The distinctive feature of this smart contract is that the release and use of funds are controlled by token-based voting. This means that token holders have the power to influence decisions on how funds are allocated, ensuring that the community’s interest is represented in the financial decisions of the company.

By employing such a governance model, the company aligns itself with decentralized finance (DeFi) principles, promoting fairness and collective decision-making. This also increases trust among users and stakeholders, as the fund management is not centralized but is instead subject to the consensus of token holders.

In conclusion, this smart contract represents a commitment to DeFi principles, operational transparency, and user engagement, with secured funds dedicated to maintaining platform functionality and rewarding active participation.

Conclusion.

In conclusion, the highlighted contract incorporates security mechanisms and is structured to ensure that the distribution of ART tokens occurs in a controlled manner, in line with the presale phase’s intended timeline. The accusation of excessive permissions to create tokens fails to consider the entire context of the contract’s operational, procedural, and technical securities.